Total Farm Safety Net Spending Drops By Two-Thirds as More Farmers Purchase Crop Insurance

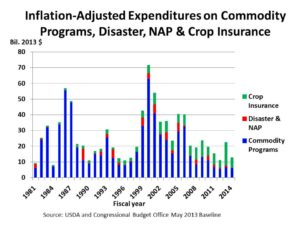

Total government spending on farm safety net programs – including all commodity programs and crop insurance – dropped by two-thirds from fiscal years 2000 to 2012, according to data provided by USDA and the Congressional Budget Office. The reduction took place as spending on commodity programs – including direct, counter-cyclical, loan deficiency and other payments which once represented the lion’s share of safety net spending – has been slowly phased down in favor of crop insurance, which is partially self-funded through farmer premiums and farmer deductibles.

In 2000, nearly $28 billion was spent on commodity programs and less than $3 billion on crop insurance. Over the course of 12 years, the overall amount of spending slowly but consistently fell and commodity spending and crop insurance spending equalized. In 2012, total farm safety net spending was $10 billion, and was split equally between the two.

In 2000, nearly $28 billion was spent on commodity programs and less than $3 billion on crop insurance. Over the course of 12 years, the overall amount of spending slowly but consistently fell and commodity spending and crop insurance spending equalized. In 2012, total farm safety net spending was $10 billion, and was split equally between the two.

During the same period, while spending on farm safety net programs dropped precipitously, the value of crop sales more than doubled, from roughly $93 billion in 2000 to nearly $220 billion in 2012. This exponential growth in crop values was cited by the Federal Reserve as one of the bright spots that brought the country out of the long recession, by bolstering rural America as well as giving a strong shot in the arm to U.S. exports.

Moving forward over the next two years, crop insurance spending will be up in 2013, due to the 2012 drought. Beyond that, USDA projections show spending on commodity programs will remain flat at $5 billion, while crop insurance spending will decline from the 2013 level. After that crop insurance spending slowly trends up, reflecting the increasing value of U.S. crops and continued expansion of crop insurance products that farmers can purchase. Also, Farm Bills proposed by both the House and the Senate will cut the overall farm safety net even more moving forward.