Crop Insurance: Private Sector Participation Enhances Policy Efficacy

Most would agree that the private sector excels at some tasks while the government is better-suited for others. This melding of the private and public sectors has yielded a crop insurance policy with affordable premiums, personalized risk management solutions and a private delivery system that puts needed monies into the hands of farmers when timing is critical.

Crop insurance covers 128 crops, including all major grain crops and cotton, nursery, citrus, rice, potatoes, and livestock. Farmers can cover their crops for all natural disasters, including wildfire, earthquake, volcanic eruptions and even irrigated water issues. Because the policy is personalized, each farmer tailors the policy to match his specific risk and desired coverage.

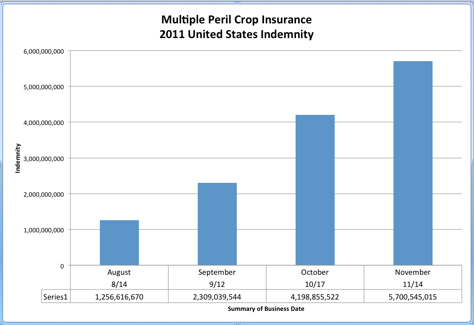

To date for 2011, the crop insurance program has paid out over $5.7 billion in indemnity payments to America’s farmers and ranchers, and that number will continue to rise over the next few months.

Corn and soybean farmer Quentin Bowen, who operates a family-farm in Humboldt, Nebraska, says that when disaster strikes, the difference in delivery of benefits when comparing government-run programs to the private sector’s handling of crop insurance, is like comparing night to day. “The speed of delivery of crop insurance—because it’s administered by private sector companies—makes it a different kind of animal. In fact, if a natural disaster strikes and I’m covered by a crop insurance policy, typically the payment comes to me in one or two weeks, not in one or two years,” he said in a recent guest column.

Following the submission of recommendations to the Super Committee for cuts in agriculture, major farm groups made clear their strong feelings on crop insurance.

In a letter to House and Senate Ag leaders, The National Association of Wheat Growers (NAWG) stated that “our highest priority for federal investment in agriculture programs is the portion of crop insurance premiums subsidized by the federal government, the public part of one of the most well-functioning public-private partnerships undertaken by our government.” NAWG also reiterated its conviction that crop insurance is the cornerstone policy for risk management, adding, “We believe crop insurance is essential to the farm safety net and the reliable production of an abundant food supply.”

A similar statement from the National Corn Growers Association noted, “the highest priority for NCGA is securing a strong crop insurance program.”

And crop insurance is apparently working quite well this year for America’s farmers, particularly those farming corn, cotton, grain sorghum, soybeans and other crops in drought-ravaged Texas. The October 23 Houston Chronicle reported that more than 41,000 farmers in Texas have received $1.65 billion so far from the national crop insurance program to help compensate for disastrous low yields and other damage caused by the state’s worst drought in history.

“The crop insurance is the linchpin and heartbeat of recovering and muscling through the disasters,” said Karis Gutter, the U.S. Department of Agriculture’s acting deputy undersecretary, who oversees all federal disaster relief efforts and foreign exports. “It will help folks get back to a semblance of normalcy in their lives.”

When farmers are trying to pick up the pieces after disaster strikes, an inefficient payment or delivery system is the last thing they need to be dealing with.