Agri-Pulse

November 4, 2016

For nearly four decades I have worked with Connecticut River Valley farmers to help protect their livelihoods. Over that time, I’ve seen many changes, both in the make-up of farms and the tools farm families have to manage uncontrollable risk.

As our population has grown, the amount of available farmland has gotten smaller. This means our farmers have had to adapt to survive. More and more local farmers today also work jobs off the farm to help support themselves, meaning we have more part-time farms. We’ve also seen an increase in diversified farms here. Many of our dairy farmers, for example, are growing their own crops for feed to help improve their bottom lines.

Our farmers—those with a passion for the land often stretching back generations—have proven to be amazing innovators in the face of challenges. But even for the best agricultural innovators, there is one thing that always remains out of their control: Mother Nature.

Here in the Connecticut River Valley, we know this all too well. We’ve seen spring seasons that have been too dry or too wet for planting. We’ve seen hailstorms come through the Upper Valley like tornadoes, bringing destruction to one area, while miraculously sparing another area just a few miles down the road. We’ve even seen hurricanes, like Irene in 2011, and blizzards in recent years.

Thankfully, as a crop insurance agent, I have also witnessed positive changes to the crop insurance system, enabling many of our farmers to protect their operations against circumstances beyond their control.

During the 1980s, which marked the beginning of the public-private partnership between the U.S. government and private insurance companies, I was among the first crop insurance agents in the region. And the program experienced plenty of growing pains.

Participation was lacking due to high costs, spotty service and slim margins. Congress was spending considerably more each year cleaning up messes after disaster struck than beforehand on protection. Lawmakers also paid far more attention to traditional Midwest crops than those specialty products more prevalent in New England.

Even as late as the early 1990s, crop insurance participation rates nationwide hovered in the 30 percent range.

Things began to change in the mid 1990s, with the passage of the Federal Crop Insurance Reform Act of 1994, which dramatically restructured the program by strengthening the partnership between the federal government and private insurers. Through premium discounts we also started to see increased participation.

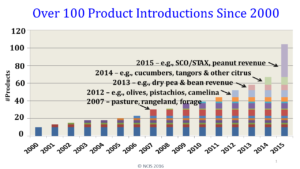

Then in May 2000, Congress approved another important piece of legislation: the Agricultural Risk Protection Act (ARPA). The provisions of ARPA made it easier for farmers to access different types of insurance products including revenue insurance and protection based on their own historical yields.

All of this has resulted in more crop insurance participants than ever before, but there was still work to be done. The Farm Bill of 2014 made crop insurance a cornerstone of U.S. farm policy and took steps to make it more affordable and available to specialty crop growers, organic producers and young farmers.

Today, crop insurance protects more than 90 percent of planted acres nationally. And it’s so popular that farmers are willing to collectively contribute about $4 billion a year from their own pockets to purchase protection and help remove some degree of risk from a very volatile business. That cost-sharing structure makes it a good investment for taxpayers as well, replacing expensive disaster bills of the past, while ensuring a safe and plentiful food supply.

No, a crop insurance check will never come close to what a farmer can get from a good harvest. Like homeowner’s insurance, farmers don’t collect a dime without a verifiable loss and paying a deductible. But crop insurance does offer farmers some peace of mind, which allows them to focus on producing higher-yielding, better-quality crops.

Connecticut River Valley farmers are inventive and hardworking businessmen and women and it has been an honor to work with them for the past 40 years. Given their ingenuity, and the important safety net crop insurance provides, the next 40 years should be exciting to watch.

Randy Odell is a Vermont crop insurance agent who has been in the industry for four decades.

Grassley recently surveyed the flood damage in several eastern Iowa cities, and discussed his experience on

Grassley recently surveyed the flood damage in several eastern Iowa cities, and discussed his experience on  California is the nation’s number one agriculture state and has been for more than 50 years, growing more than half of the nation’s fruits, vegetables, and nuts. We paid a visit to Richard Selover, a farmer in Colusa, CA, a small farming community in Northern California, approximately 75 miles north of Sacramento, to find out why crop insurance is important to his farming operation.

California is the nation’s number one agriculture state and has been for more than 50 years, growing more than half of the nation’s fruits, vegetables, and nuts. We paid a visit to Richard Selover, a farmer in Colusa, CA, a small farming community in Northern California, approximately 75 miles north of Sacramento, to find out why crop insurance is important to his farming operation.