CONVO 50

Farmers spend tens of thousands of dollars and then pray for good weather. If it all comes together, you’ve got a bountiful harvest and you’re set for the next year. If it doesn’t, then hopefully you have crop insurance.

Farmers spend tens of thousands of dollars and then pray for good weather. If it all comes together, you’ve got a bountiful harvest and you’re set for the next year. If it doesn’t, then hopefully you have crop insurance.

Private companies are integral to crop insurance’s future because they shoulder risk that would otherwise be borne by taxpayers and because they maintain the system used to efficiently provide assistance to farm families following disasters.

However if the business does not remain viable, private-sector participation could wane, which would weaken America’s farm policy, according to a new video released today by National Crop Insurance Services (NCIS).

“Key to this viability is a reasonable rate of return for insurers on the infrastructure they built to deliver farmers’ most important risk management tool,” the video explained. “An adequate return on investment enables insurance providers to routinely reinvest in technology, infrastructure efficiency, and service improvements for farmers and ranchers. Unfortunately, adequate returns don’t always happen.”

Among the factors that have made crop insurance less viable in recent years:

· Weather disasters and crop price volatility since 2011 have resulted in record loss payments from crop insurance providers;

· $1.2 billion a year in federal funding was cut in 2008 and 2011; and

· Farm policy opponents are targeting crop insurance for further funding reductions.

The 2014 Farm Bill took steps towards improving crop insurance by expanding coverage, by bringing new customers into the system, and by providing new tools to continually minimize waste, fraud, and abuse.

Tom Zacharias, president of NCIS, applauded Congress’ actions and said it will be important to continue making improvements by reducing regulatory burdens, avoiding further funding cuts, and keeping crop insurance actuarially sound. And he believes that all Americans have a stake in the future of crop insurance.

“After all, not everyone farms, but everyone eats. So everyone depends on a strong farm policy,” the video concluded.

The NCIS video, which can be viewed here, is the last in a three-part series dedicated to the key policy attributes essential to crop insurance’s continued success. Previous pieces examined the importance of making crop insurance widely available and affordable to farmers.

###

Crop insurance providers recently released the first in a series of educational videos meant to highlight three policy attributes that are essential to maintaining a strong crop insurance system in the face of future market and weather challenges.

The first three-minute segment examines the widespread availability of crop insurance, whereas future videos will look at the affordability of policies and the viability of private-sector delivery.

“Congress cemented crop insurance’s role as the centerpiece of the farm safety net during the 2014 Farm Bill,” explained Tom Zacharias, National Crop Insurance Services president. “However, that safety net will collapse if crop insurance policies aren’t widely available, aren’t affordable to producers, and aren’t economically viable to be administered by efficient private insurance providers.”

According to the first video, “Crop insurance is similar to other kinds of insurance. The more people who purchase policies, the more people who help share risk. And when risk can be spread out along a broader base, it helps lower the cost for everyone.”

That is why it is it is so important for insurance to be available for all kinds of crops and to farmers of all sizes and backgrounds, NCIS noted.

“The more the merrier. From corn and cotton to cherries and canola, every single acre enrolled helps strengthen the whole system,” the video explained.

The recently passed 2014 Farm Bill took big steps to make crop insurance more available to beginning farmers, organic producers, and fruit and vegetable growers. Lawmakers also stopped legislative attempts to reduce insurance benefits available to larger farms – a plan that would have raised costs on all farmers and increased taxpayers’ risk exposure.

“Congress got it right by making crop insurance more widely available and stronger than ever. Now, we just need to keep it that way,” the video concluded. “After all, not everyone farms, but everyone eats. So everyone depends on a strong farm policy.”

The NCIS video can be viewed here. Segments on affordability and viability will be released in the coming weeks.

Shawn Holladay, a fourth-generation cotton farmer from Dawson County, Texas, looks to agriculture as his sole source of income. It’s not a bad argument for wanting the status quo to continue.

Ask one who’s been in farming for decades for his proverbial ‘staying power’ and he will likely tell you farming is a beloved legacy, he has a passion for growing crops that ensure the well-being of Americans, and throw in a bit of spiel about how crop insurance has made it possible for him to survive against nature’s odds.

For 25 years, Holladay has used crop insurance to protect his 6,500-acre farmland in Lamesa — devoted to cotton, some grains and peanuts — and ensure its stability in the face of prolonged drought. Especially vulnerable are farms like his that have been in families for three or four generations.

“My operation could not begin to stand the losses associated with drought and the severe weather without it,” said Holladay, an industry leader and cotton grower who has won the Farm Press/Cotton Foundation High Cotton Award for his conservation and sustainable farming practices. “The current drought would have taken out most, if not all, farms in the area where my operation is located.”

Read Shawn’s story here.

Farming in central Ohio tends to be very even-keel, largely due to the great soil we sit on and the favorable climatic conditions in most years. Local crops, including corn, soybeans and wheat, tend to come in at fairly predictable yields, offering local farmers some peace of mind in a business known for its risk.

That whole equation was turned on its head in 2012, which will be forever seared in the minds of those of us who work the land as the Great Drought of 2012. Thankfully, most farmers here in central Ohio, like me, purchase crop insurance every year.

Crop insurance is a public-private partnership whereby farmers purchase individual policies with their own money and tailored to their own risk tolerance.

Folks who are not involved directly in farming don’t understand the enormous costs — for fertilizer, seed, machinery, labor and herbicide — that must be shouldered by farmers in order to get a crop in the ground. Farmers spend tens of thousands of dollars, then pray for good weather. If it all comes together, you’ve got a bountiful harvest and you’re set for the next year. If it doesn’t, hopefully you have crop insurance.

Now, crop insurance is also no small expense. In 2013, our farming operation’s crop-insurance premium totaled more than my wife’s annual salary as a local teacher. And in most years, we don’t make a claim. It’s just like homeowner’s insurance — you hope you never need to make a claim.

During the 2012 drought, farmers talked about how awful things were, but, curiously, none mentioned the possibility of losing their farms. That’s because they had all purchased crop insurance, knowing that if the bottom fell out, they had a backup plan.

And thankfully, for consumers in the U.S. and abroad, those farmers were back again in 2013, producing the healthiest, best and most affordable food in the world.

Matthew King is a farmer from Radnor, Ohio. This op-ed appeared in the Columbus Dispatch on October 18, 2014.

Crop insurance policies must remain affordable for farmers and ranchers or the entire farm safety net will fail, crop insurance providers said today in a new educational video.

Farmers help fund current farm policy by spending approximately $4 billion a year out of their own pockets on crop insurance policies and by shouldering a portion of losses in the form of deductibles before receiving assistance.

“But if insurance bills get too big, or deductible losses get too high, fewer farmers will sign up for policies, and the whole system will collapse,” noted the video. “If that happens, not only will it be harder for farm families to bounce back after disaster, but costs that are currently being borne by farmers and private insurance providers will shift back to taxpayers.”

Congress took steps in the 2014 Farm Bill to keep crop insurance affordable. Among the steps spotlighted in the video:

This is the second in a series of educational videos meant to highlight three policy attributes that are essential to maintaining a strong crop insurance system. The first three-minute segment examined the importance of making crop insurance, widely available, and a future piece will look at maintaining the viability of private-sector delivery.

“Congress cemented crop insurance’s role as the centerpiece of the farm safety net during the 2014 Farm Bill,” explained Tom Zacharias, president of National Crop Insurance Services (NCIS), the trade group that sponsored the video series. “However, that safety net will breakdown if crop insurance policies aren’t widely available, aren’t affordable to producers, and aren’t economically viable to be administered by efficient private insurance providers.”

The affordability video can be viewed here. Other videos are available on NCIS’ YouTube channel.

Production agriculture is constantly changing. Crop insurance is right there, making sure farmers have a modern and affordable risk management tool at their disposal.

Production agriculture is constantly changing. Crop insurance is right there, making sure farmers have a modern and affordable risk management tool at their disposal.

Specialty crop farmers, organic farmers and diversified producers will now be able to purchase the protection of crop insurance as part of a Whole-Farm Revenue Protection insurance policy. “Crop insurance options continue to adapt to meet the farm safety net needs of today’s farmers,” said Risk Management Agency (RMA) Administrator Brandon Willis.

Whole-Farm Revenue Protection, passed as part of the 2014 Farm Bill, will offer fruit and vegetable growers and producers with diversified farms selling commodities to wholesale markets, local and regional markets, farm identity preserved markets, or direct markets, more flexible, affordable risk management coverage options. “Whole-Farm Protection insurance will expand options for specialty crop, organic and diversified crop producers, allowing them to insure all the crops at once instead of one commodity at a time,” noted Willis.

The new policy will offer a whole-farm premium discount to farms with two or more commodities as long as minimum diversification requirements are met. This will provide diversified farms a higher premium discount that previously available. The policies will also allow farmers to insure all crops and livestock under one insurance policy in lieu of insuring each commodity separately.

Willis noted that the new policy, as part of the overall 2014 Farm Bill, will build on historic economic gains in rural America over the next five years while also achieving billions of dollars of savings for taxpayers.

As a crop insurance agent, I can tell you firsthand that crop insurance is no small expense for most of the state’s farmers, who spend north of $20,000 a year purchasing policies that they pray they will not need.

One side benefit of the popular “eating local” movement is a growing recognition by urbanites and suburbanites of the importance of agriculture and the need to ensure that farmers are able to withstand the many challenges presented by Mother Nature. While farmers manage their many risks using a wide variety of tactics, there is one tool in most farmers’ risk management portfolio, which they consider indispensable: crop insurance.

The value of crop insurance to New England’s farmers was made crystal clear in 2012 by Tropical Storm Irene, which brought heavy winds and even heavier rains just as crops were nearing harvest. While 2011 saw record losses across the U.S. with freezes in Florida, drought in the Southwest and floods in the Midwest, it was farmers in Vermont who sustained the highest loss ratios in the country. As a crop insurance agent, I can attest that many of our farmers saw their entire crops devoured in one day as floodwaters, sometimes six feet high, swallowed their fields.

After the waters finally receded and the extent of the damage to their farms was assessed, it quickly became clear that Irene’s wallop had the potential of being a “game changer” for many New England farmers. And crop insurance was the only thing that saved many of them from losing their farms to bankruptcy and instead allowed them to return to their fields this spring and plant.

View the entire story here.

The 2014 Farm Bill was clearly a turning point in federal policy towards agriculture, pivoting away from the traditional support mechanism paradigm of the past and into a risk management model that features crop insurance as farmers’ primary—or only—risk management tool. But with that new emphasis comes an increased need for basic information about crop insurance, what it is, how it works and why it has become the risk management tool of choice for America’s farmers.

These basics of crop insurance are available in an NCIS video titled “Crop Insurance 101.” The video is very helpful for Americans who have very little to do with agriculture, or for those who now find themselves needing to know more about this important risk management tool.

The video explains the public-private partnership of the crop insurance, the way crop insurance has removed some of the risk burden from taxpayers, and the role adjusters, and the companies they work for, play in the crop insurance program. It also explains that in order to be protected by crop insurance, farmers must first purchase it with their own money. Already this year, farmers have spent nearly $4 billion purchasing crop insurance.

Shawn Holladay, a fourth-generation cotton farmer from Dawson County, Texas, looks to agriculture as his sole source of income. It’s not a bad argument for wanting the status quo to continue.

Shawn Holladay, a fourth-generation cotton farmer from Dawson County, Texas, looks to agriculture as his sole source of income. It’s not a bad argument for wanting the status quo to continue.

Ask one who’s been in farming for decades for his proverbial ‘staying power’ and he will likely tell you farming is a beloved legacy, he has a passion for growing crops that ensure the well-being of Americans, and throw in a bit of spiel about how crop insurance has made it possible for him to survive against nature’s odds.

For 25 years, Holladay has used crop insurance to protect his 6,500-acre farmland in Lamesa—devoted to cotton, some grains and peanuts—and ensure its stability in the face of prolonged drought. Especially vulnerable are farms like his that have been in families for three or four generations.

“My operation could not begin to stand the losses associated with drought and the severe weather without it,” said Holladay, an industry leader and cotton grower who has won the Farm Press/Cotton Foundation High Cotton Award for his conservation and sustainable farming practices. “The current drought would have taken out most, if not all, farms in the area where my operation is located.”

For Holladay, crop insurance has been mostly a budgetary expense. But he religiously takes out a policy year after year to keep his operation viable, especially with the current drought in Texas that has lasted three years and incurred losses for many Texas farmers.

“When our production is up to par we pay premiums and there have been many years when I have received no indemnity,” he said.

But he is also realistic about attitude toward his insurance.

“Crop insurance is established on production levels that are averaged over 10 years. The only cost effective purchase of insurance comes with a deductible of 20-40 percent. When considering the huge increase in input costs the U.S. farmer still has to be able to stand a significant amount of the loss between the actual production and the break-even on the farm. To be able to do this requires an efficient operation,” Holladay explained.

One of the most important things to consider when developing a safety net is the farms that are producing the lion’s share of the goods. “Penalizing your most efficient operations through payment limits and AGI (Adjustment Gross Income) determinations is self-defeating,” he argued.

The safety net aspect of crop insurance is vital for the United States farm industries to compete globally in the face of a volatile world economy.

“Our ability as a country to be self-sufficient in food and fiber is imperative,” he maintained. “The day we are not able to sustain a profitable ag industry will be a shift in our very identity as a country.”

A well-crafted farm bill that provides a cost-effective safety net is essential if the U.S. is serious about keeping its edge in the market.

“Our ability to keep producing the abundant, safe, supply of farm goods is in jeopardy if we don’t consider other countries and what they are doing when it comes to subsidies,” he theorized. “U.S. farmers have increased efficiency and for the most part increased in size to achieve economies of scale.”

For the most part, increased acreage and efficiency are essential to combat slim margins, Holladay said. And such can only be possible in an operation that is secure and thriving.

People hear a lot about crop insurance and the fact that U.S. farmers spend $4 billion out of their own pockets to purchase it every year. One of the greatest praises of our modern crop insurance system is the customer service that farmers receive before, but perhaps more importantly after, they have a loss. For some farmers, the hours after a major farm disaster can seem like the lowest point in their lives, when their careers seem to be upended and their hopes for a big harvest dashed.

But quickly after a major loss occurs, crop insurance adjusters are on the scene to meet with the farmers assess the damage. The crop insurance adjusters are one of the unsung heroes of the farm safety net, since they help ensure that when disaster strikes that help – in the form of a crop insurance indemnity check – is on the way.

Before ever climbing in the truck, crop adjusters are already on the phone making business calls, watching the weather forecast, reading the rain gauge, and checking in with their clients. They spend long days in the office and even longer days out on the road. Right beside the farmer as they walk through their fields, these men and women are at the very heart of why crop insurance is successful.

Art Wiebelhaus is one person in particular who exemplifies just what it takes to be a crop adjuster. He recognizes the commitment crop production takes, the need crop insurance fulfills, and the lifestyle agriculture holds. From his understandings, Art utilizes a dynamic relationship between crop insurance, farming, community, and family.

While he has been a crop adjuster for just six years, Art has been a farmer his whole life. As a third generation farmer, “I know what they are going through and what their worries are. I’m a farmer too,” commiserates Art. Imagine waking up one day to your life’s work destroyed by events beyond your control–producers must carry around this possibility (and lump in their throat) every day. It is an adjuster’s job to provide farmers with the aid they seek from crop insurance.

As producers dread the day when they must make a claim, Art is still able to make light of the situation. He laughs, “It seems that when it rains, it just keeps raining, and when it’s dry, it just stays dry.”

Growing up on the same place he now farms, Art has seen crop insurance grow around his own sleepy little town of Fordyce, Nebraska, “A while back I remember meeting one gentleman who didn’t have crop insurance, and that’s because there wasn’t a policy that really worked for his operation. Of course now, with improvements and changes to crop insurance, he has coverage. And today, I can’t name one person who doesn’t have crop insurance.”

“With current prices, farmers have to have crop insurance to stay in business,” points out Art. The loss of just one year can be so catastrophic that an operation cannot financially come back from it. Keeping a farmer’s “head above water” means another year that he is able to meet the demands of food production.

This is where the importance of an adjuster comes into play. They make the loss calculations for every insured field based upon scientific procedures. From these adjustments, it is determined how crop insurance policies can pay. Creating a tie to the producer, adjusters work with their clients to provide assessments that will have a positive impact on the operation’s future.

Along with this, crop adjusters must be conscientious of their actions in order for this process to be successful. For the best results Art says that, “Every time I visit a field, I have two goals in mind: make the most accurate adjustment; and make sure the farmer feels that he can rely on my judgment.”

To reach this goal, “It’s very important that you clearly explain the procedures and how you came up with the loss adjustment total,” describes Art. Presenting these steps provides the farmer with an understanding as to how the loss was determined. Art’s appreciation for the producer is repaid with equal gratitude when he takes the extra time to help his clients.

From each visit, Art is one-step closer to a stronger relationship with the farmer. This is important to Art, because it is the reason he started adjusting in the first place.

“I always enjoyed visiting with my crop adjuster when he came out to my farm. He kept bringing up how he thought I would make a great adjuster,” tells Art, “I knew how much he had helped my farm operation, and I wanted to be able to do the same for others. I finally made the call and have loved my job ever since.”

It is not uncommon to find an adjuster like Art—one who has a passion for helping his community. But what is exceptional about him is that despite the fact that he must cover at least three different states at a time, being able to serve and contribute to agriculture is all Art asks for in return.

“Just like any job, there are trying times. But overall I enjoy my job, because I know that I am able to help the farmer,” explains Art.

Adjusters are the face of crop insurance, and make a direct impact on the perception of the industry. Besides their agent, a client will spend most of their time working with an adjuster when unfortunate weather strikes. It is important to remember that, “This is not only a business, but a livelihood; they [farmers] need to be reassured that they won’t lose what is very close and personal to them,” notes Art. How an adjuster interacts with a client will not go unnoticed or forgotten; a crucial point as to why crop insurance will always need adjusters like Art.

From developing a dedicated relationship, to mentoring farmers about procedures, Art brings a positive impact on crop insurance every day.

The U.S. Department of Agriculture (USDA) announced recently that it continues to make progress in implementing provisions of the 2014 Farm Bill that will strengthen and expand insurance coverage options for farmers and ranchers. The new Supplemental Coverage Option (SCO), available through the federal crop insurance program and set to begin with the 2015 crop year, is designed to help protect producers from yield and market volatility.

USDA Secretary Tom Vilsack pointed out that this nation’s producers work hard to produce a sufficient amount of safe and nutritious food for the country. “It’s critical that they have crop insurance options to effectively manage risks and ensure that they do not lose everything due to events beyond their control,” he said. Vilsack added that USDA has made it a priority to ensure the Supplemental Coverage Option was available to help farmers in this upcoming crop year.

The 2014 Farm Bill strengthens and expands crop insurance by providing more risk management options for farmers and ranchers and by making crop insurance more affordable for beginning farmers. SCO, which is administered by the Risk Management Agency (RMA), further strengthens the farm safety net.

SCO will be available for corn, cotton, grain sorghum, rice, soybeans, spring barley, spring wheat, and winter wheat in selected counties for the 2015 crop year. Producers should contact their crop insurance agents to discuss eligibility in time to sign up for winter wheat coverage. RMA plans to make SCO more widely available by adding more counties and crops. Information on SCO for 2015 winter and spring wheat is available on the RMA website.

SCO is a county-level policy endorsement that is in addition to an underlying crop insurance policy, and covers a portion of losses not covered by the same crop’s underlying policy. Producers who elect to participate in Agricultural Risk Coverage (ARC), which is offered by the Farm Service Agency (FSA), are not eligible for SCO for the crop and farm participating in ARC.

Vilsack noted today’s announcement was made possible by the 2014 Farm Bill. The Farm Bill builds on historic economic gains in rural America over the past five years, while achieving meaningful reform and billions of dollars in savings for taxpayers. For more information, visit www.usda.gov/farmbill.

People hear a lot about crop insurance and the fact that U.S. farmers spend $4 billion out of their own pockets to purchase it every year. One of the greatest praises of our modern crop insurance system is the customer service that farmers receive before, but perhaps more importantly after, they have a loss. For some farmers, the hours after a major farm disaster can seem like the lowest point in their lives, when their careers seem to be upended and their hopes for a big harvest dashed.

But quickly after a major loss occurs, crop insurance adjusters are on the scene to meet with the farmers assess the damage. The crop insurance adjusters are one of the unsung heroes of the farm safety net, since they help ensure that when disaster strikes that help – in the form of a crop insurance indemnity check – is on the way.

Before ever climbing in the truck, crop adjusters are already on the phone making business calls, watching the weather forecast, reading the rain gauge, and checking in with their clients. They spend long days in the office and even longer days out on the road. Right beside the farmer as they walk through their fields, these men and women are at the very heart of why crop insurance is successful.

Art Wiebelhaus is one person in particular who exemplifies just what it takes to be a crop adjuster. He recognizes the commitment crop production takes, the need crop insurance fulfills, and the lifestyle agriculture holds. From his understandings, Art utilizes a dynamic relationship between crop insurance, farming, community, and family.

While he has been a crop adjuster for just six years, Art has been a farmer his whole life. As a third generation farmer, “I know what they are going through and what their worries are. I’m a farmer too,” commiserates Art. Imagine waking up one day to your life’s work destroyed by events beyond your control–producers must carry around this possibility (and lump in their throat) every day. It is an adjuster’s job to provide farmers with the aid they seek from crop insurance.

As producers dread the day when they must make a claim, Art is still able to make light of the situation. He laughs, “It seems that when it rains, it just keeps raining, and when it’s dry, it just stays dry.”

Growing up on the same place he now farms, Art has seen crop insurance grow around his own sleepy little town of Fordyce, Nebraska, “A while back I remember meeting one gentleman who didn’t have crop insurance, and that’s because there wasn’t a policy that really worked for his operation. Of course now, with improvements and changes to crop insurance, he has coverage. And today, I can’t name one person who doesn’t have crop insurance.”

“With current prices, farmers have to have crop insurance to stay in business,” points out Art. The loss of just one year can be so catastrophic that an operation cannot financially come back from it. Keeping a farmer’s “head above water” means another year that he is able to meet the demands of food production.

This is where the importance of an adjuster comes into play. They make the loss calculations for every insured field based upon scientific procedures. From these adjustments, it is determined how crop insurance policies can pay. Creating a tie to the producer, adjusters work with their clients to provide assessments that will have a positive impact on the operation’s future.

Along with this, crop adjusters must be conscientious of their actions in order for this process to be successful. For the best results Art says that, “Every time I visit a field, I have two goals in mind: make the most accurate adjustment; and make sure the farmer feels that he can rely on my judgment.”

To reach this goal, “It’s very important that you clearly explain the procedures and how you came up with the loss adjustment total,” describes Art. Presenting these steps provides the farmer with an understanding as to how the loss was determined. Art’s appreciation for the producer is repaid with equal gratitude when he takes the extra time to help his clients.

From each visit, Art is one-step closer to a stronger relationship with the farmer. This is important to Art, because it is the reason he started adjusting in the first place.

“I always enjoyed visiting with my crop adjuster when he came out to my farm. He kept bringing up how he thought I would make a great adjuster,” tells Art, “I knew how much he had helped my farm operation, and I wanted to be able to do the same for others. I finally made the call and have loved my job ever since.”

It is not uncommon to find an adjuster like Art—one who has a passion for helping his community. But what is exceptional about him is that despite the fact that he must cover at least three different states at a time, being able to serve and contribute to agriculture is all Art asks for in return.

“Just like any job, there are trying times. But overall I enjoy my job, because I know that I am able to help the farmer,” explains Art.

Adjusters are the face of crop insurance, and make a direct impact on the perception of the industry. Besides their agent, a client will spend most of their time working with an adjuster when unfortunate weather strikes. It is important to remember that, “This is not only a business, but a livelihood; they [farmers] need to be reassured that they won’t lose what is very close and personal to them,” notes Art. How an adjuster interacts with a client will not go unnoticed or forgotten; a crucial point as to why crop insurance will always need adjusters like Art.

From developing a dedicated relationship, to mentoring farmers about procedures, Art brings a positive impact on crop insurance every day.

Their policy, most people forget, will have a 20 percent deductible to it. How would you like to have a homeowner’s policy with a 20 percent deductible?

On the first Saturday after Thanksgiving, you can chase a greased pig in the southwestern Georgia town of Climax as it celebrates its Swine Time Festival, which normally draws up to 30,000 people in an area where only 300 people live.

There is also corn shucking and a squeal-off. Climax is the highest point on the railroad line between Savannah and the Chattahoochee River. After its founding in the 1880s, the town served as a rail junction and an agricultural community. It was incorporated in 1905.

The weather for a farmer in Climax can be tricky. The town is located only a few dozen miles from the Gulf of Mexico which can bring in hurricanes as powerful as Katrina, which struck New Orleans with devastating fury in 2005. But this corner of southern Georgia has also been hit by a drought that rivals the one which hit this year in the U.S. Midwest, shriveling the cotton and peanuts that farmers grow in the area.

“We’re 90 miles from the Gulf of Mexico. We had a tropical storm come through in [20]09. We’re so close to the coast that we have to have some type of insurance,” said Andy Bell, who farms about 2,000 acres outside town. On the other hand, “2007 was a terrible, dry year.”

“We buy crop insurance every year,” said Bell. “We typically buy 70 percent [of coverage]. You’re not going to make any money but it will prevent you from losing the farm.”

His main crops are peanuts, cotton and corn. Some 700 acres are sown to peanuts, about 1,100 acres to cotton and about 200 acres to corn. There is also a small herd of about 200 beef cattle.

Bell said there were some anxious moments before Hurricane Isaac veered away from their area a few months ago and headed for New Orleans. The storm season, which does not end until November 30, remains a threat, but the end to hurricane season is not far off.

For once, Bell is looking forward to harvest season as it looks like the weather is going to cooperate. “I think the peanut crop is going to be good this year. We dodged a bullet when the storm went the other way,” said Bell, who began farming in 1982.

The average yield for peanut farms would run around 1 to 3 tons per acre. But just as Bell suspected, this year yields will be at record highs. USDA forecasts it at a record 3,714 pounds per acre, which would be 400 + pounds higher than last year.

Bell’s cotton crop is also in pretty good shape, with the Georgia farmer saying they may approach the yields of a few years ago when the harvest stood at 1,300 to 1,400 lbs an acre. That is pretty good considering the national average is about 800 pounds an acre.

His main problem though is the price of cotton. Since scaling a record high at $2.27 a pound in March 2011, cotton prices have shriveled and are now trading around $.75 a pound. “We have (had) a price collapse,” he said.

In good years and bad, Bell said crop insurance is indispensable simply because the weather in his area is so unpredictable. “It can rain here and then five miles down the road, you get no rain,” he said. Bell noted that crop insurance is ”not a fix-all”, but it gives farmers a chance to come back after a bad year.

For him, removing crop insurance is unthinkable. Banks and other lending institutions would not extend any credit to farmers if there is no safety net like crop insurance to give them some assurance that they will get part of their money back.

“I think it would be catastrophic,” Bell declared. “He [the American farmer] would be out of business. We’ve got to have some form of insurance.”

Crop insurance reached significant and historic milestones in 2013 — both in its formal recognition by Congress as the primary risk management tool for farmers and the volume of protection it offered — according to an article released in the May 2014 edition of Crop Insurance TODAY.

“Again in 2013, crop insurance helped farmers deal with the year’s weather and market risks,” noted authors Keith Collins and Harun Bulut. “Crop insurance was singled out by legislators during the development of the new Farm Bill as the primary program supporting production agriculture and was heralded as indispensable for successful farming today,” they added.

The ability of farmers to rely on the crop insurance policies they had purchased gave them confidence to plant yet another year of near record total production, the authors explain. “Farmers were able to plant 325 million acres in the spring of 2013, down slightly from a year earlier but four million [acres] above the previous five year average.”

The article points out that looking to the future, the public can rest assured that crop insurance will be in place to provide financial stability for the many small, family farms that comprise the core of U.S. farm production. “Crop insurance will ensure that when the repeated disasters of recent years strike again, as they most assuredly will, U.S. farmers will be able to bounce back to produce again at high levels the food, feed, fiber and energy crops which the U.S. and world populations have come to expect and depend [upon],” they said.

In many parts of Oklahoma, it seems like wheat farmers just can’t catch a break.

A late spring freeze, combined with excessively dry or extreme drought conditions throughout the winter and into spring have left many of the state’s wheat fields badly stressed or a complete bust. I’d say this is the worst I’ve ever seen, and I started farming in the mid 1950s.

With the wheat harvest set to begin in about a month, farmers are expected to harvest about 40 percent less wheat this year than they did in 2013. The low soil moisture has left many farmers wondering what they are about to go through.

For the state’s farmers who purchased crop insurance – and nowadays that’s nearly all of them – that will be their only saving grace. I don’t know of a farmer anywhere in Oklahoma who doesn’t buy crop insurance. It’s just like buying diesel fuel today…you don’t farm without it.

With the passage of the new Farm Bill, largely gone are the days of the Federal government stepping after a calamity. Today, when a farm crisis hits, farmers turn to their crop insurance policy, not the Federal government, for help. The public-private partnership that is today’s crop insurance ensures that farmers get the financial help they need in weeks, not years.

As a crop insurance agent, I can tell you firsthand that crop insurance is no small expense for most of the state’s farmers, who spend north of $20,000 a year purchasing policies that they pray they will not need.

Farmers buy crop insurance today just like they buy homeowners insurance. And when a good year turns into a bust, the only thing standing between some farmers and bankruptcy is their crop insurance policies.

Last year, Oklahoma farmers spent more than $93 million to purchase the peace of mind of crop insurance. Crop insurance allows individual farmers to purchase the coverage they need, tailored to their farms, financial standing and tolerance to risk.

For farmers who rely on loans to operate – and that’s a lot of farmers – crop insurance has become a bank’s best friend. In fact, the best collateral you can take to a bank when you are seeking a loan is your crop insurance policy.

Crop insurance is not only smart farm policy, but smart consumer policy as well. American consumers have come to see our affordable, abundant food supply as a birthright. In fact, most of us alive today have never seen wide-scale hunger in this country. But much of what we take for granted could quickly disappear if we allow our farmers to fail and were forced to import our food, fiber and fuel.

While this might be the worst drought I’ve ever seen, I have to say that my faith in the resilience and work ethic of Oklahoma’s farmers is undying, and I know that with their crop insurance policies as a backstop, our farmers will bounce back from this.

Max Claybaker is a farmer and a crop insurance insurance agent from Blackwell, Oklahoma. This op-ed appeared in The Oklahoman on June 1, 2014.

In many parts of Oklahoma, it seems like wheat farmers just can’t catch a break.

Not a one.

A late spring freeze, combined with excessively dry or extreme drought conditions throughout the winter and into spring have left many of the state’s wheat fields badly stressed or a complete bust. In fact, I’d say this is the worst I’ve ever seen, and I started farming here in the mid 1950s.

With the wheat harvest set to begin in about a month, farmers are expected to harvest about 40 percent less wheat this year than they did in 2013. The low soil moisture as we head into the hottest and driest months of the year has left many farmers wondering what they are about to go through.

For the state’s farmers who purchased crop insurance – and nowadays that’s nearly all of them – that will be their only saving grace. I don’t know of a farmer anywhere in Oklahoma who doesn’t buy crop insurance. It’s just like buying diesel fuel today…you don’t farm without it.

With the passage of the new Farm Bill, largely gone are the days of the Federal government stepping in and helping farmers who have been hit by a calamity.

Such bills cost taxpayers tens of billions of dollars in the past, and were not only expensive but also slow to deliver the help to the farmers who needed it. Today, when a farm crisis hits, farmers turn to their crop insurance policy, not the Federal government, for help. The public-private partnership that is today’s crop insurance ensures that farmers get the financial help they need in weeks, not years.

As a crop insurance agent, I can tell you firsthand that crop insurance is no small expense for most of the state’s farmers, who spend north of $20,000 a year purchasing policies that they pray they will not need. Of course there are smaller farmers and larger farmers, whose premiums exceed $70,000, but the point is that it isn’t cheap.

Farmers buy crop insurance today just like they buy homeowners and car insurance. And when what looks like a promising year turns into a bust, the only thing standing between some farmers and bankruptcy is their crop insurance policies.

Last year, Oklahoma farmers spent more than $91 million out of their own pockets to purchase the peace of mind and protection of crop insurance.

Crop insurance allows individual farmers to purchase the coverage they need, tailored to their farms, their financial standing and their tolerance to risk.

For farmers who rely on loans to operate – and that’s a lot of farmers – crop insurance has become a bank’s best friend. In fact, the best collateral you can take to a bank when you are seeking a loan is your crop insurance policy. The bank will often co-sign the policy with the farmer, and in doing so, they are assured that part of their loan is covered, regardless of weather or price swings.

Crop insurance is not only smart farm policy, but smart consumer policy as well. American consumers have come to see our affordable, abundant food supply as a birthright. In fact, most of us alive today have never seen wide-scale hunger in this country. But much of what we take for granted could quickly disappear if we allow our farmers to fail and were forced to import our food, fiber and fuel. That is not a position many of us would choose to be in and it underscores the fact that having a strong farm sector is a national security issue.

While this might be the worst drought I’ve ever seen, I have to say that my faith in the resilience and work ethic of Oklahoma’s farmers is undying, and I know that with their crop insurance policies as a backstop, our farmers will bounce back from this. When Congress addresses crop insurance in the next Farm Bill five years down the road, I hope it is to protect the public-private partnership that has made it successful and to further improve and expand its protection.

Max Claybaker is a farmer and a crop insurance insurance agent from Blackwell, Oklahoma. This op-ed appeared in The Oklahoman on June 1, 2014.

In many parts of Oklahoma, it seems like wheat farmers just can’t catch a break.

Not a one.

A late spring freeze, combined with excessively dry or extreme drought conditions throughout the winter and into spring have left many of the state’s wheat fields badly stressed or a complete bust. In fact, I’d say this is the worst I’ve ever seen, and I started farming here in the mid 1950s.

With the wheat harvest set to begin in about a month, farmers are expected to harvest about 40 percent less wheat this year than they did in 2013. The low soil moisture as we head into the hottest and driest months of the year has left many farmers wondering what they are about to go through.

For the state’s farmers who purchased crop insurance – and nowadays that’s nearly all of them – that will be their only saving grace. I don’t know of a farmer anywhere in Oklahoma who doesn’t buy crop insurance. It’s just like buying diesel fuel today…you don’t farm without it.

With the passage of the new Farm Bill, largely gone are the days of the Federal government stepping in and helping farmers who have been hit by a calamity.

Such bills cost taxpayers tens of billions of dollars in the past, and were not only expensive but also slow to deliver the help to the farmers who needed it. Today, when a farm crisis hits, farmers turn to their crop insurance policy, not the Federal government, for help. The public-private partnership that is today’s crop insurance ensures that farmers get the financial help they need in weeks, not years.

As a crop insurance agent, I can tell you firsthand that crop insurance is no small expense for most of the state’s farmers, who spend north of $20,000 a year purchasing policies that they pray they will not need. Of course there are smaller farmers and larger farmers, whose premiums exceed $70,000, but the point is that it isn’t cheap.

Farmers buy crop insurance today just like they buy homeowners and car insurance. And when what looks like a promising year turns into a bust, the only thing standing between some farmers and bankruptcy is their crop insurance policies.

Last year, Oklahoma farmers spent more than $91 million out of their own pockets to purchase the peace of mind and protection of crop insurance.

Crop insurance allows individual farmers to purchase the coverage they need, tailored to their farms, their financial standing and their tolerance to risk.

For farmers who rely on loans to operate – and that’s a lot of farmers – crop insurance has become a bank’s best friend. In fact, the best collateral you can take to a bank when you are seeking a loan is your crop insurance policy. The bank will often co-sign the policy with the farmer, and in doing so, they are assured that part of their loan is covered, regardless of weather or price swings.

Crop insurance is not only smart farm policy, but smart consumer policy as well. American consumers have come to see our affordable, abundant food supply as a birthright. In fact, most of us alive today have never seen wide-scale hunger in this country. But much of what we take for granted could quickly disappear if we allow our farmers to fail and were forced to import our food, fiber and fuel. That is not a position many of us would choose to be in and it underscores the fact that having a strong farm sector is a national security issue.

While this might be the worst drought I’ve ever seen, I have to say that my faith in the resilience and work ethic of Oklahoma’s farmers is undying, and I know that with their crop insurance policies as a backstop, our farmers will bounce back from this. When Congress addresses crop insurance in the next Farm Bill five years down the road, I hope it is to protect the public-private partnership that has made it successful and to further improve and expand its protection.

Max Claybaker is a farmer and a crop insurance insurance agent from Blackwell, Oklahoma. This op-ed appeared in The Oklahoman on June 1, 2014.

(OVERLAND PARK, Kan.) — Crop insurance reached significant and historic milestones in 2013 — both in its formal recognition by Congress as the primary risk management tool for farmers and the volume of protection it offered — according to an article released in the May 2014 edition of Crop Insurance TODAY.

“Again in 2013, crop insurance helped farmers deal with the year’s weather and market risks,” noted authors Keith Collins and Harun Bulut. “Crop insurance was singled out by legislators during the development of the new Farm Bill as the primary program supporting production agriculture and was heralded as indispensable for successful farming today,” they added.

The ability of farmers to rely on the crop insurance policies they had purchased gave them confidence to plant yet another year of near record total production, the authors explain. “Farmers were able to plant 325 million acres in the spring of 2013, down slightly from a year earlier but four million [acres] above the previous five year average.”

The article points out that looking to the future, the public can rest assured that crop insurance will be in place to provide financial stability for the many small, family farms that comprise the core of U.S. farm production. “Crop insurance will ensure that when the repeated disasters of recent years strike again, as they most assuredly will, U.S. farmers will be able to bounce back to produce again at high levels the food, feed, fiber and energy crops which the U.S. and world populations have come to expect and depend,” they said.

-#-

“California’s reservoirs obviously will not be significantly replenished by a melting snowpack this spring and summer,” concluded the year-end snow survey by the California Department of Water Resources.

The mountain snowpack is critical to the state’s water needs and provides roughly one-third of the water for California’s farms and cities. “Today’s final snow survey of the year found more bare ground than snow as California faces another long, hot summer after a near-record dry winter,” the report said.

The May 1 survey found the state’s snowpack at a mere 18 percent of average for the date. “With most of the wet season behind us, it is highly unlikely late-season storms will significantly dampen the effects of the three-year drought on parched farms or communities…” the report noted.

According to the May 13, 2014 U.S. Drought Monitor the entire state of California is experiencing severe drought conditions. More than three-quarters of the state is suffering a state of “extreme drought,” a seventeen percent increase from three months earlier this year, with nearly 25 percent of the state experiencing “exceptional” drought, a fifteen percent increase from three months earlier.

The ongoing drought is hitting the state’s farmers and growers hard. California is the nation’s top agricultural state, with farming generating approximately $37.5 billion a year, growing roughly half of the nation’s fruits, nuts and vegetables.

California farmers purchased more than 25,000 crop insurance policies in 2013, protecting more than 5 million acres. Those policies protect crops ranging from almonds, apples and avacadoes to sugarbeets, Valenicia oranges and walnuts. To purchase those policies, California farmers paid more than $95 million out of their pockets and protected more than $6 billion in liability.

Losing a crop is very disappointing, especially when you are at the very end, you are close to harvest, you put all of this time and money into it, and then you lose it. That is when it is nice to have crop insurance.

I’ve spent the last 17 years of my life farming in North Dakota and I’ve loved every minute of it. But it can be a very risky business. There are many steps that farmers can take to manage risk, like growing a wide variety of crops, rotating crops and growing cover crops to prevent erosion. And we do all of that.

But let’s face it, when we get an early August freeze, or a spring flood, or a drought, just about all of the best farming practices in the world will fail to protect us. And that is why I, like most farmers across the state, always purchase crop insurance. In fact, last year North Dakota farmers spent more than $38 million out of their own pockets purchasing crop insurance policies.

It’s just a smart business decision. There has never been a year when we didn’t have crop insurance. Sure, it costs a lot of money, and that money could be spent elsewhere. But that would be a penny wise and pound foolish, since going through a natural disaster can cost you the farm.

This isn’t a hypothetical argument. In fact, last spring during planting, we had 18 inches of rain in 21 days. In between downpours we planted what we could, but by the time the rain was finished, we couldn’t get back into the fields to finish planting. In other words, we started off our growing season with only half a crop. Thankfully, our crop insurance policy covered that kind of loss. We certainly didn’t make a dime from the policy, but the indemnity check helped cover the rent on the land and the lost fertilizer that had been laid on a field that couldn’t be planted.

The passage of the new Farm Bill this year marks a pivotal stage in U.S. farm policy. Gone are the days of direct payments and large disaster bills aimed at helping farmers after natural disasters. In its place is crop insurance, which has been embraced by farmers, farm groups and lenders alike. Farmers who don’t purchase crop insurance need to realize that the federal government is no longer going to come along with an ad hoc disaster bill and bail us out.

The centerpiece of the new risk management strategy on the farm is crop insurance, which is sold and serviced by private insurance companies and partially discounted by the federal government. The government’s role – helping to ensure that crop insurance is affordable to farmers – has remade the face of crop insurance from a policy that for many years was largely unknown and underused to a risk management tool that last year protected 90 percent of planted cropland.

Crop insurance is not only popular with farmers, but with bankers as well. In fact, most farmers need to show proof of a crop insurance policy when they meet with bankers to secure production loans. The banks realize what a risky loan they are making, and are more likely to take that risk if they have the relative protection of crop insurance.

Crop insurance is good public policy for farmers, bankers, and taxpayers alike. In the past, extensive droughts like what much of the nation experienced in 2012 would have triggered an enormous ad hoc disaster bill in Congress. But since the vast majority of the cropland was protected by crop insurance during the worst drought to hit the nation since the Dust Bowl days, farmers sought assistance from their crop insurance policies, not the federal government.

Crop insurance, like all public policies, has its detractors, however. And before the ink is even dry on the new Farm Bill, these groups are plotting their assault on crop insurance. They have their sights set on the premium discount, the very thing that makes crop insurance affordable to farmers. Without the discount, farmers like me couldn’t afford to purchase crop insurance. And if a large-scale natural disaster hits and farms across the country fail, where is our food going to come from? I don’t think most Americans would want to be in a position of relying on other nations for our food in addition to our fuel.

Crop insurance is good public policy because it helps underpin farmers, who are enormous consumers and literally drive the rural economy. Americans spend about10 percent of their incomes on food, among the lowest of any country. With the proper risk management tools in hand for farmers, the promise of a safe and affordable food supply will not only be a legacy for our children, but for the world’s growing population as well.

Diane McDonald, from Inkster, North Dakota, is the national media chairperson for Women Involved in Farm Economics (WIFE).

This op-ed appeared in Agri-Pulse on April 8, 2014.

Today, crop insurance is the foundation of this Farm Bill and the farm safety net. The farmer gets a bill, not a check with crop insurance…and they don’t get help unless they really need it.

If there’s anything the droughts of 2011 and 2012 have taught American farmers, it’s the importance of being prepared for anything.

If there’s anything the droughts of 2011 and 2012 have taught American farmers, it’s the importance of being prepared for anything.

That includes occasional years of dealing with dry conditions trying to grow the Carolinas’ homegrown cotton crop.

J. Michael Quinn, the president and CEO of Carolinas Cotton Growers Cooperative, Inc., has witnessed how both droughts and hurricanes can wreak havoc on farms and cause lost income for farmers.

What is important is how such risks are mitigated now that farmer-members have turned to crop insurance coverage for protection.

“Crop losses will occur from time to time,” he noted, adding “these losses would be devastating to private underwriting and cost prohibitive without a public/private partnership to underwrite and deliver the appropriate protection.”

He maintained the widespread crop losses of 2011 and 2012 due to drought are a “clear reminder of the need for crop insurance protection.”

The farmers who are members of the cooperative have also had to deal with the terrible destruction of hurricanes, which seem to strike the Carolinas like clockwork.

In 1999, Hurricane Floyd dumped so much rain and caused such heavy destruction and flooding in the Carolinas — which had suffered from Hurricane Dennis just weeks before — that the World Meteorological Organization has retired the name.

In all this devastation, which could very well have bankrupted many farmers, those who had purchased crop insurance were able to roll with the punches and come back the following year.

“Crop insurance is very vital in a farmer’s overall risk management strategy,” said Quinn.

Crop insurance and the marketing loans are major provisions in the Farm Bill, and play an important role in cooperative marketing. He said the marketing loan program has allowed cooperatives like Carolinas Cotton Growers Cooperative “to facilitate loans on behalf of the producer while the crop is being marketed.” Crop insurance is a risk management tool the growers can customize to their individual needs, he added.

The 91-year-old cooperative, headquartered in Garner, North Carolina, provides marketing services by connecting members to textile customers around the world. The cooperative manages the logistics of moving the members’ cotton in the world supply chain in an efficient manner and provides the latest tools for members to hedge risks inherent in production agriculture.

“The nature and volatility of agricultural production necessitates the need for an adequate safety net for producers who take substantial risk in producing crops,” said Quinn.

A solid Farm Bill, he said, gives agricultural lenders a “certain degree of confidence in terms of multi-year lending of agricultural production and ensures a certain measure of food and fiber security.” A well-crafted farm bill is as important to American farmers as it is to American citizens, he said.

Crop insurance is a program that ensures that farmers who suffer possibly catastrophic losses from droughts and floods can survive and stay in business. The risk management tool provides coverage to over one hundred crops, and offers producers a variety of options to choose from depending on how much they are willing to spend and their tolerance for risk.

Bee County in the coastal bend of Texas near the Gulf of Mexico was not spared the crippling drought which struck the state with the worst dry spell in almost a century in 2011 and continued for several years.

Bee County in the coastal bend of Texas near the Gulf of Mexico was not spared the crippling drought which struck the state with the worst dry spell in almost a century in 2011 and continued for several years.

Matt Huie works on 5,000 acres of row crops plus a cow-calf operation there, and the headquarters of his operation is near Beeville, Texas. He has been farming the last 15 years since graduating from college.

For him, crop insurance has been invaluable. Huie calls it “the most vital risk management tool” in his quiver. “We always buy it, and have since we started,” said Huie.

“It’s required to secure loans in our area. Because of the severe drought in Texas, we have used it two of the last three years. Without it we would be out of business, along with two-thirds of the farmers in our area,” he said.

Huie explained that crop insurance enables farmers to survive disasters like searing drought or devastating floods so they can farm again the following year. The farmers pay premiums into the program so they can recoup some of their losses, which is a better alternative than ad hoc disaster aid that would have to pass through a Congress that is often stalemated by partisan debate.

Huie said crop insurance is “even more important to young farmers like us who are more leveraged” in providing collateral to keep their operations running.

He also disputed claims by some critics that farmers care more about collecting an insurance check than raising a crop. “If you have ever had an insurance claim on anything, be it a homeowners claim or an automobile, you know that it helps shield you from a catastrophic loss. But in reality, it’s (just) making the best of a bad situation,” he said.

Like other insurance policies, there is a deductible involved which is “usually 30 percent in our area,” he added.

Huie said he hopes people will understand the importance of the work farmers do, even in a society where most take for granted that safe, affordable food is readily available in their supermarkets.

“In a global market where competing nations recognize the strategic importance of maintaining a domestic agriculture industry, subsidies will continue to exist because there is no greater threat to a government than to have people that are hungry,” he said.

When farmers like Huie file a crop insurance claim, they only do so after suffering a loss.

“A common misconception people have is that crop insurance guarantees a profit. Wrong!” he declared.

“There are a few groups out there that would like to paint a different view of farmers, fat cats that live on handouts. There may be some of those out there, but I don’t know them,” Huie stated.

“The farmers I know study the most efficient, economical way to grow a crop,” Huie added. “They rush to fertilize and plant with faith that Mother Nature will bring rain and crops will grow to sell at harvest. They agonize over the weather, insects, decisions, and generally sleep very poorly during the growing season. Those are not the traits of a fat cat.”

Since the new 2014 Farm Bill was signed into law, questions have arisen about how this new legislation affects crop insurance and the farmers who rely on it. Detailed answers to questions, ranging from major and minor policy changes, the introduction of new products including SCO and STAX and the link between the premium discount and conservation are all detailed in the newly released version of Crop Insurance: Just the Facts.

“The 2014 Farm Bill is a turning point in federal policy towards agriculture, pivoting away from the traditional support mechanism paradigm of the past and into a risk management model that features crop insurance as farmers’ primary — or only — risk management tool,” noted Tom Zacharias, president of National Crop Insurance Services.

Crop Insurance: Just the Facts, a popular online resource that provides the A to Z overview of Federal crop insurance resides here, on the Crop Insurance Keeps America Growing website page “About Crop Insurance” where it is continuously updated.

“This resource has proved invaluable to farmers, students and policy experts who need to better understand the nuts and bolts of crop insurance,” said Zacharias.

In addition to addressing the various aspects of the new Farm Bill, the online series covers important topics such as how crop insurance benefits the public, economics of the industry, risk management in global terms, how crop insurance benefits producers and many other important issues.

Zacharias noted that crop insurance discussions are replete with exaggerations and misrepresentations about this important risk management tool. “Crop Insurance: Just the Facts, provides the details in an easy to read, reasoned and balanced perspective,” he said.

Passage of the 2014 Farm Bill, which cemented crop insurance as the cornerstone of farm policy, proved that crop insurance’s popularity among farmers has reached an all-time high, said Tim Weber, co-chairman of the American Association of Crop Insurers and National Crop Insurance Services.

Passage of the 2014 Farm Bill, which cemented crop insurance as the cornerstone of farm policy, proved that crop insurance’s popularity among farmers has reached an all-time high, said Tim Weber, co-chairman of the American Association of Crop Insurers and National Crop Insurance Services.

“If I had to sum up the story of the crop insurance industry in one simple statement, I think it would have to be ‘We’ve made a lot progress but our best years remain ahead of us,’” Weber said today during his opening remarks at the annual conference sponsored by National Crop Insurance Services and the American Association of Crop Insurers in February.

Since its inception in 1938, crop insurance has steadily evolved and today protects 90 percent of planted cropland in America. The industry won widespread praise in agricultural circles and on Capitol Hill for helping rural America quickly rebound after the devastating droughts of 2012.

“There can be no question that when it comes to managing the risks posed by Mother Nature or volatile world markets, federal crop insurance has no equal,” he said, adding “it has reached its pinnacle, all while overall federal spending on farm programs has trended down.”

Weber explained that in order to continue to build on past successes, the industry should rely on the same three keys that helped its rise to prominence: Affordability, availability and viability.

In order for crop insurance to remain viable as farmers’ primary risk management tool, the crop insurance infrastructure must remain financially strong, he said. Additionally, customer service, program integrity, and widespread participation will be paramount. And unless crop insurance remains affordable and available to all, Weber believes the entire system could collapse.

Crop insurers faced attempts to reduce program participation during the Farm Bill, but proposals to cap crop insurance benefits and force some farmers to pay higher premiums failed.

“We applaud our congressional leaders for overwhelmingly passing a Farm Bill that strengthens, not weakens, our commitment to crop insurance even in the face of federal spending pressure,” Weber concluded. “I truly believe that 10 years down the road, when we look back at the 2014 Farm Bill, it will be elevated to one of the major legislative initiatives that established landmark developments for crop insurance and production agriculture.”

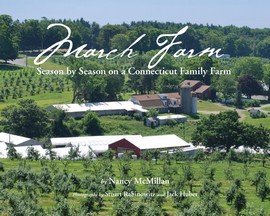

In 1915, Thomas and Rose Marchukaitis, two Lithuanian immigrants who had been in the country for only a few years, purchased a farm in Bethlehem, Connecticut, which consisted of 114 acres and supported 15 cows and two horses. There, they raised their nine children and worked hard for their American dream.

In 1915, Thomas and Rose Marchukaitis, two Lithuanian immigrants who had been in the country for only a few years, purchased a farm in Bethlehem, Connecticut, which consisted of 114 acres and supported 15 cows and two horses. There, they raised their nine children and worked hard for their American dream.

Three generations later, their grandson, Tom March, is still farming that parcel of land, which has grown to 150 acres, along with his brother-in-law and their two sons. “We’re a diversified farm, because you have to be,” said March, whose farm consists of about 75 acres of sweet corn, 30 acres of apples, 4 acres of peaches, along with some strawberries and blueberries.

March took over the farm from his father in 1976 and has been at it ever since. Most farmers are quick to recount their “really bad year,” but Mother Nature has been unusually cruel to the March Farms with a long string of natural disasters.

“Having just one bad year would have actually been good news for us,” said March. Six out the last seven years, March Farms has had hail damage on their apple crop, one of their largest sources of revenue. “In 2012, I lost 90 percent of my apple crop on that late frost and then the other 10 percent was demolished by hail,” said March. “For my peaches, another big crop on my farm, I’ve also had major losses six out of the last seven years,” he noted.

“Needless to say, if I hadn’t purchased crop insurance, I would have had many lean years in a row.” March has been purchasing crop insurance for more than a decade, and said that he can’t imagine farming without it.

March said that he had high hopes for this year, thinking that he might be able to break the bad streak and post a big bumper crop across the board. And then, it started raining. And it rained, and rained, and rained. “This year, it’s been so wet, I haven’t been able to get any corn in the ground, and it’s already July,” he noted. “The tractors just couldn’t get through that mess.” Soon, it will be too late to plant corn altogether, as days shorten and nights get cooler.

March explained that crop insurance allows farmers to pick up the pieces when a disaster, or a string of disasters, hit. “In farming, you only get one shot at this. If you lose a crop, you’re generally done for the season,” he said.

March explained that while a late spring frost can completely destroy an orchard’s earning potential for the year, it doesn’t remove its ongoing costs.

“Farmers need access to crop insurance to stay in business, it’s as simple as that,” he said.

“If your apples freeze off at the beginning of the year, what are you going to do for income?” he asked. “You not only lost a crop, but you also have the long-term maintenance cost on the trees, weed control, pruning, pest control and then getting the trees ready for next year. So you have lots of cost and little income,” he explained.

That’s when purchasing crop insurance turns into a saving grace. The crop insurance indemnity offers both peace of mind, and financial backing to pay off production loans or to buy inputs for the next year.

March noted that generally, people don’t go into farming to make a lot of money, but because it’s a passion and a good, healthy way of life. “The only time you make any money in farming is when you grow something out of season, or when there’s a major disaster elsewhere and your crops are in good shape,” he said.

Like many other farmers both large and small, March is incensed by crop insurance opponents who malign farmers by claiming that crop insurance only helps a handful of rich farmers get richer. March said the statement itself shows how little these critics know about farming, or farmers. “You try growing this stuff and try raising a farm and see how much money you make,” he said. “Don’t give us this nonsense about how much money we make, because it’s not true,” he said. “They see the income numbers, but they have no idea of the costs.”

March explained that every year, March Farms gets through it one way or the other. “What are you going to do, cry over spilled milk or pick up the pieces and move forward?” he asked.

“We always manage to pull through,” he said.

“In addition to covering a host of other crop insurance-related issues, the newly released online resource also addresses major and minor policy changes in the 2014 Farm Bill, including the introduction of new products including SCO and STAX, new products available for beginning farmers, the link between the premium discount and conservation and newly authorized pilot programs.” Dr. Keith Collins, economic consultant to National Crop Insurance Services

“In addition to covering a host of other crop insurance-related issues, the newly released online resource also addresses major and minor policy changes in the 2014 Farm Bill, including the introduction of new products including SCO and STAX, new products available for beginning farmers, the link between the premium discount and conservation and newly authorized pilot programs.” Dr. Keith Collins, economic consultant to National Crop Insurance Services

(OVERLAND PARK, Kan.) — As the 2014 Farm Bill was signed into law, questions have arisen about how this new legislation affects crop insurance and the farmers who rely on it. A detailed analysis that will answer those questions, including major and minor policy changes, the introduction of new products including SCO and STAX and the link between the premium discount and conservation are all detailed in the newly released version of Crop Insurance: Just the Facts.

“The 2014 Farm Bill is a turning point in federal policy towards agriculture, pivoting away from the traditional support mechanism paradigm of the past and into a risk management model that features crop insurance as farmers’ primary — or only — risk management tool,” noted Tom Zacharias, President of National Crop Insurance Services.

Crop Insurance: Just the Facts, a popular online resource that provides the A to Z overview of federal crop insurance resides here, on the Crop Insurance Keeps America Growing website page “About Crop Insurance” where it is continuously updated.

“This resource has proved invaluable to farmers, students and policy experts who need to better understand the nuts and bolts of crop insurance,” said Zacharias.

In addition to addressing the various aspects of the new Farm Bill, the online series covers important topics such as how crop insurance benefits the public, economics of the industry, risk management in global terms, how crop insurance benefits producers and many other important issues.

Zacharias noted that when it comes to the important details of crop insurance, the reason why farmers, farm groups, the financial community and lenders have thrown their strong support behind crop insurance, and why it has evolved into the main risk management tool for American agriculture, discussions are replete with exaggerations and misrepresentations about crop insurance. “Crop Insurance: Just the Facts, provides the details in an easy to read, reasoned and balanced perspective,” he said.

###

(SCOTTSDALE, ARIZ.) – Kent Petersen, Hudson Crop Insurance, Robert Parkerson, ProAg Insurance, Russell Slade, Diversified Crop Insurance Services, and Charles “Chuck” Lassey, retired, were presented with a Crop Insurance Industry Lifetime Achievement Award at the 2014 Crop Insurance Industry Annual Convention. Tim Weber, Chairman of the National Crop Insurance Services (NCIS) Board of Directors, and Tom Zacharias, President of NCIS, presented the awards.

KENT PETERSEN

Kent Petersen began his career in the crop insurance industry almost 40 years ago. From 1973 to 1990, Kent worked for Crop Hail Management, starting as a crop insurance adjuster and working up through the ranks to become the chief operations officer. From 1990 to 1992, Kent assisted with the transition and in 1992 was named manager of underwriting and reinsurance for Rural Community Insurance Services. He served in that position until 1997.

Kent Petersen began his career in the crop insurance industry almost 40 years ago. From 1973 to 1990, Kent worked for Crop Hail Management, starting as a crop insurance adjuster and working up through the ranks to become the chief operations officer. From 1990 to 1992, Kent assisted with the transition and in 1992 was named manager of underwriting and reinsurance for Rural Community Insurance Services. He served in that position until 1997.

After a brief retirement from the industry, Kent returned to the industry as president of CropUSA in January of 2003. In 2008, Hudson Insurance Company purchased the assets of CropUSA and the employment contracts of many employees. Kent supported that transition and was named senior vice president of Hudson Insurance Company and President of Hudson Crop. He remained in that position until his retirement in September 2013.

Kent was a member of many industry organizations including serving on the NCIS Board of Directors from 1992-1997. He was also an active member of the American Association of Crop Insurers, serving as a strong advocate for the crop insurance industry.

Mr. Petersen was unable to attend the convention so accepting the award on his behalf was Dan Gasser, Hudson Crop Insurance.

ROBERT PARKERSON

Robert “Bob” Parkerson has been dedicated to the crop insurance industry for many years, and in a leadership position since the early 1990s. Bob worked with Old Republic in the 1980s, at a time when they were the largest industry company in the MPCI program. He became president of National Crop Insurance Services (NCIS) at a time when the industry was in need of a true leader, which Bob filled with class and dignity.

Robert “Bob” Parkerson has been dedicated to the crop insurance industry for many years, and in a leadership position since the early 1990s. Bob worked with Old Republic in the 1980s, at a time when they were the largest industry company in the MPCI program. He became president of National Crop Insurance Services (NCIS) at a time when the industry was in need of a true leader, which Bob filled with class and dignity.

As president of NCIS for 17 years, Bob was instrumental in the industry growing from a group that was struggling to reach $1 billion in premium to a powerhouse industry that exceeds $12 billion in premiums. Each step forward along this path included Bob representing the industry with patient guidance, leadership and respect from other crop insurance stakeholders. Bob was more often than not the first person reached out to on critical issues with USDA, Congress, reinsurance companies and the press.