Issue Summary:

Having a strong agricultural sector that provides an abundant and affordable supply of food and fiber is key to any country’s security, which explains why most countries have farm policies in place to help promote and sustain domestic production.

A key component to America’s food, fiber, and farm policy is crop insurance, a public-private partnership that has constantly evolved and improved over the years. Today’s crop insurance system marries the best of government and the business community to speed assistance to farmers when they need it the most while limiting taxpayer exposure.

Recent weather disasters underscore crop insurance’s importance and explain why many farmers consider it their most important risk management tool. In fact, for producers of many specialty crops, crop insurance is the only risk management tool available.

Policy Overview:

There are 15 private sector insurance companies that currently sell and service policies through the federal crop insurance program. These companies are regulated by law and through a contractual agreement with the government that ensures coverage is available to any grower who wants insurance regardless of geographic location or risk.

Altogether, these companies issued more than 1.1 million policies in 2010. To make sure premiums are affordable and policies are abundant, the federal government helps underwrite a portion of the premiums for policies purchased by individual farmers. Without some government involvement, there would likely be little or no multiple peril crop insurance available today.

Should damages occur during a growing season, losses are determined by private loss adjusters, quickly followed by policyholders receiving their payments from private insurance companies.

Approximately 80 percent of U.S. principal crop acreage was enrolled in crop insurance, with 256 million acres under policies worth $80 billion in total coverage.

Federal funding for crop insurance has been drastically trimmed in recent years, with more than $12 billion in cuts made since the 2008 farm bill. Many in the crop insurance business worry that additional cuts would so weaken the infrastructure that the program could not function as Congress intended or as farmers need.

And without an effective risk management structure in place, taxpayers would wind up footing the bill for expensive ad hoc disaster packages following adverse events. Most experts agree that without some government support, there would be little or no multiple peril crop insurance available today.

Policy Strengths:

Crop insurance ensures that producers share in risk management decisions and program costs: Because producers pay part of the premium and purchase the specific type of policy that exactly fits their needs, crop insurance ensures a very tailored approach to risk management.

Crop insurance is important for securing loans: Banks can be hesitant in making loans to farmers, particularly to smaller producers, because the risks are inherently high. Banks regard a crop insurance policy as collateral in making what might otherwise be a very risky, and costly loan to farmers who need to raise capital.

Crop insurance benefits from efficient private-sector delivery: Crop insurance combines the accessibility of the public sector with the efficiency of the private sector in ensuring that covered farmers who face catastrophe receive the proper level of payments in a timely manner. This can mean the difference between staying in business another year or going under for many farm families.

Proponents of Crop Insurance:

Crop insurance has enjoyed widespread public recognition and support. In fact, its biggest detractors seem to be libertarians, who argue for the end of most government programs.

Unfortunately, without some government involvement, crop insurance policies would be too expensive for farmers to purchase, and it would be too costly for insurance companies to offer universally available multi-peril coverage.

What They’re Saying:

“Failure to anticipate an imminent downturn in the agricultural economy by not maintaining farm policies through the farm bill and crop insurance… would, in time, prove penny wise and pound foolish.”

— A letter to House Budget Committee from nearly 30 farm groups.

“Most farmers now see [crop insurance] as a primary tool for risk management. An important tool for risk management.”

— USDA Chief Economist Joseph Glauber

“It’s just a real good risk management tool. We’re able to have famers pay part of the premium and have government pay part of the premium to make it affordable and it just ensures that if we have tough weather – especially like we’re having now – lots of wildfires in Texas and a lot of flooding in the Midwest, that farmers are able to indeed get enough assistance that they can farm for another year.”

–Mary Kay Thatcher, American Farm Bureau Federation,

Senior Director of Congressional Relations.

“Farm policy in general, and crop insurance in particular, will help weather-ravaged growers pick up the pieces and farm another day. It does so for less than one-quarter of 1 percent of the federal budget..”

— Roger Johnson, President, National Farmers Union

“Farmers like me need to have access to affordable risk management tools to better mitigate the impact of significant crop losses and sharp price declines. This is why the upcoming farm bill is so important. It is not about providing income to the less than 2% of the American population. It is about insuring that the same 2% can continue to provide affordable food for the other 98% of Americans who rely on them.”

— Testimony Of Clark Gerstacker,

Michigan Farmer, Before the U.S. Senate Agriculture Committee

“For 80 years now, we’ve been providing a safety net that helps people stay in business so that they’ll have a chance to try again next year. Without it, there’s no doubt we would have higher food prices.”

— Joe Outlaw, co-director of the Agriculture and Food Policy Center,

Texas A&M University

Useful Links:

National Crop Insurance Services

A mule-drawn cultivating team in the 1910’s. Around the time this photo was taken, the crop insurance industry started the agronomic research program that is still working today to understand the impact of nature’s perils on crops.

A mule-drawn cultivating team in the 1910’s. Around the time this photo was taken, the crop insurance industry started the agronomic research program that is still working today to understand the impact of nature’s perils on crops. Simulating hail with an ice blowing machine. The crop insurance industry funded the development of these machines in the 1980’s to simulate realistic crop damage for loss adjuster schools. They are still in use today.

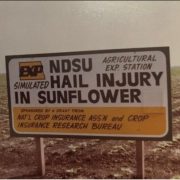

Simulating hail with an ice blowing machine. The crop insurance industry funded the development of these machines in the 1980’s to simulate realistic crop damage for loss adjuster schools. They are still in use today. NCIS conducts research across the country. North Dakota is a favorite research location because it is the northernmost location for a diversity of insured crops. In the late 1970’s and early 1980’s, sunflower research was prolific in North Dakota!

NCIS conducts research across the country. North Dakota is a favorite research location because it is the northernmost location for a diversity of insured crops. In the late 1970’s and early 1980’s, sunflower research was prolific in North Dakota!