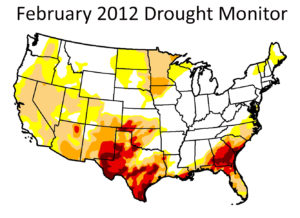

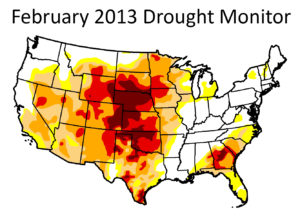

There are few places in the country that personify the radical whims of Mother Nature as well as the state of Iowa. Last year, Iowa and much of the upper Midwest suffered under record flooding when major rivers left their banks. This year, Iowa farmers are facing one of the worst droughts in decades. The entire state is experiencing drought conditions that are considered either “severe or extreme.”

Leo Ettleman, an Iowa farmer who lost nearly everything last year to the flood waters of the Missouri, was back on his feet again this year planting his fields and hoping for better luck. “The house, the barn, all the buildings, all the fields, everything was swallowed by the great Missouri,” Ettleman said of last year.

Ettleman says that through it all, having crop insurance gave him a “great peace of mind” knowing that when the waters receded, he, his father and his son could return to farming. The Ettlemans are likely again drawing some comfort from the fact that they always purchase crop insurance to hedge the unpredictability of Mother Nature.

Leo Ettleman, Percival, Iowa

The Ettleman farm is located on some of the richest bottomland in the state; in the part of the country that many believe is one of the best locations on earth to farm corn and soybeans. Leo Ettleman has been farming his whole life, and in his 57 years on the fourth-generation family farm that is close to the Missouri river, he’s well aware of the ups and downs of farming on bottomland: “In the good years, it’s the best land around and your yields will be high,” said Ettleman. “But in the bad years, flooding is always a possibility.”

The Ettleman farm – which consists about 2,300 acres of corn and soybeans plus a cow-calf operation – has flooded before, in 2008 and 1993, but that was mostly due to the fact that high water in the river kept his land from draining and the water just sat on the saturated fields. But nothing in living memory could prepare the family for what they would be facing in 2011.

The year actually started off great, with adequate rainfall over the winter and into the early spring. By April, the corn and soybeans were doing well, and crop prices were steadily ticking up. “Yes, 2011 could definitely be a good year,” Ettleman thought to himself.

Then came the rain, both directly on his farm, but more importantly far upstream. Record snowfall during the winter in the Rockies, which carried more than double its average snowpack, began melting quickly. This, combined with heavy spring rains, which according to the National Weather Service dumped nearly a year’s worth of rain in a two-week period over the upper Missouri River basin, would spell inundation for those living downstream.

By Memorial Day weekend, the news came to families near the Missouri River that they would have to evacuate for two weeks. Ettleman explained that the task before them was enormous, as three generations of the Ettleman family, living in three different houses, and all of the livestock and machinery, were to be moved to higher ground. “But moving to higher ground and hoping for the best was the only option,” he said.

On June 13, the first breach occurred in the long flood control system, roughly 10 miles south of their farm, near Hamburg, Iowa. On June 30, the crisis hit much closer to home as the levee failed near his parents’ home in Fremont. That signaled the beginning of a massive inundation that would leave nearly every farm in every direction under five feet of water. It would last four months.

By the time the levees failed, the Missouri River, which is normally a few hundred feet wide in this part of Iowa, was six miles across where the Ettlemans live.

“The house, the barn, all the buildings, all the fields, everything was swallowed by the great Missouri,” Ettleman said. June, July, August, and even into September, the water was still there. “We could get on a levee and drive down to where we could keep an eye on our property with binoculars and so we knew we had 3 to 5 feet of water against our house but the structure was not destroyed,” he said.

Ettleman and the other farmers in the area attended disaster meetings at the local high school and were apprised of the status of the flood and what to expect once the water left.

Thankfully for Ettleman, he had purchased 80 percent multi-peril coverage on his crops, along with rain and hail damage. Ettleman says that through it all, having crop insurance gave him a “great peace of mind” knowing that when the waters receded, he, his father and his son could return to farming.

Ettleman worked directly with his crop insurance agent and the local claims adjuster to ensure that everyone had everything they needed to get his claim filed. “We got the paperwork started early to get the ball rolling so that when it was time to file my claim, I’d be ready,” he said.

When the Missouri finally receded it left a strange, almost lunar landscape in its path. “Everything was a mess,” he said. “There was three feet of sand in my parent’s house.” The fields were full of trees, debris, trash, and scour holes that could swallow your car. “There were 3 to 5 foot sand drifts in the middle of some of my best fields,” he added. “In some places, I had lost 2 to 3 feet of topsoil from some of my most productive fields.”

With his claim filed and the promise of an indemnity check on its way, Ettleman and his family worked the fields diligently over the winter, testing the soil to see if it could support a crop the following spring and filling the large holes left by the river with the copious amounts of sand that it had also deposited on their farm. And what a difference a year – and an indemnity – can make.

“Right now,” he said, “we’re looking a whole lot better than we thought we would, with 99 percent of our farm planted for the 2012 crop.”

“There’s only about 3 acres that have so much sand on them that we couldn’t plant them,” he noted, “and that will give us something to do this winter.”