CROP INSURANCE IN ACTION: Tom March, Bethlehem, Connecticut

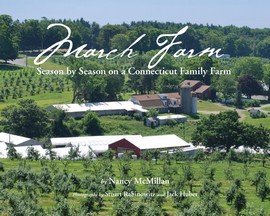

In 1915, Thomas and Rose Marchukaitis, two Lithuanian immigrants who had been in the country for only a few years, purchased a farm in Bethlehem, Connecticut, which consisted of 114 acres and supported 15 cows and two horses. There, they raised their nine children and worked hard for their American dream.

In 1915, Thomas and Rose Marchukaitis, two Lithuanian immigrants who had been in the country for only a few years, purchased a farm in Bethlehem, Connecticut, which consisted of 114 acres and supported 15 cows and two horses. There, they raised their nine children and worked hard for their American dream.

Three generations later, their grandson, Tom March, is still farming that parcel of land, which has grown to 150 acres, along with his brother-in-law and their two sons. “We’re a diversified farm, because you have to be,” said March, whose farm consists of about 75 acres of sweet corn, 30 acres of apples, 4 acres of peaches, along with some strawberries and blueberries.

March took over the farm from his father in 1976 and has been at it ever since. Most farmers are quick to recount their “really bad year,” but Mother Nature has been unusually cruel to the March Farms with a long string of natural disasters.

“Having just one bad year would have actually been good news for us,” said March. Six out the last seven years, March Farms has had hail damage on their apple crop, one of their largest sources of revenue. “In 2012, I lost 90 percent of my apple crop on that late frost and then the other 10 percent was demolished by hail,” said March. “For my peaches, another big crop on my farm, I’ve also had major losses six out of the last seven years,” he noted.

“Needless to say, if I hadn’t purchased crop insurance, I would have had many lean years in a row.” March has been purchasing crop insurance for more than a decade, and said that he can’t imagine farming without it.

March said that he had high hopes for this year, thinking that he might be able to break the bad streak and post a big bumper crop across the board. And then, it started raining. And it rained, and rained, and rained. “This year, it’s been so wet, I haven’t been able to get any corn in the ground, and it’s already July,” he noted. “The tractors just couldn’t get through that mess.” Soon, it will be too late to plant corn altogether, as days shorten and nights get cooler.

March explained that crop insurance allows farmers to pick up the pieces when a disaster, or a string of disasters, hit. “In farming, you only get one shot at this. If you lose a crop, you’re generally done for the season,” he said.

March explained that while a late spring frost can completely destroy an orchard’s earning potential for the year, it doesn’t remove its ongoing costs.

“Farmers need access to crop insurance to stay in business, it’s as simple as that,” he said.

“If your apples freeze off at the beginning of the year, what are you going to do for income?” he asked. “You not only lost a crop, but you also have the long-term maintenance cost on the trees, weed control, pruning, pest control and then getting the trees ready for next year. So you have lots of cost and little income,” he explained.

That’s when purchasing crop insurance turns into a saving grace. The crop insurance indemnity offers both peace of mind, and financial backing to pay off production loans or to buy inputs for the next year.

March noted that generally, people don’t go into farming to make a lot of money, but because it’s a passion and a good, healthy way of life. “The only time you make any money in farming is when you grow something out of season, or when there’s a major disaster elsewhere and your crops are in good shape,” he said.

Like many other farmers both large and small, March is incensed by crop insurance opponents who malign farmers by claiming that crop insurance only helps a handful of rich farmers get richer. March said the statement itself shows how little these critics know about farming, or farmers. “You try growing this stuff and try raising a farm and see how much money you make,” he said. “Don’t give us this nonsense about how much money we make, because it’s not true,” he said. “They see the income numbers, but they have no idea of the costs.”

March explained that every year, March Farms gets through it one way or the other. “What are you going to do, cry over spilled milk or pick up the pieces and move forward?” he asked.

“We always manage to pull through,” he said.